Weekend Rundown: Filters for Base after decline | Crypto-Vrypto | Own yourself

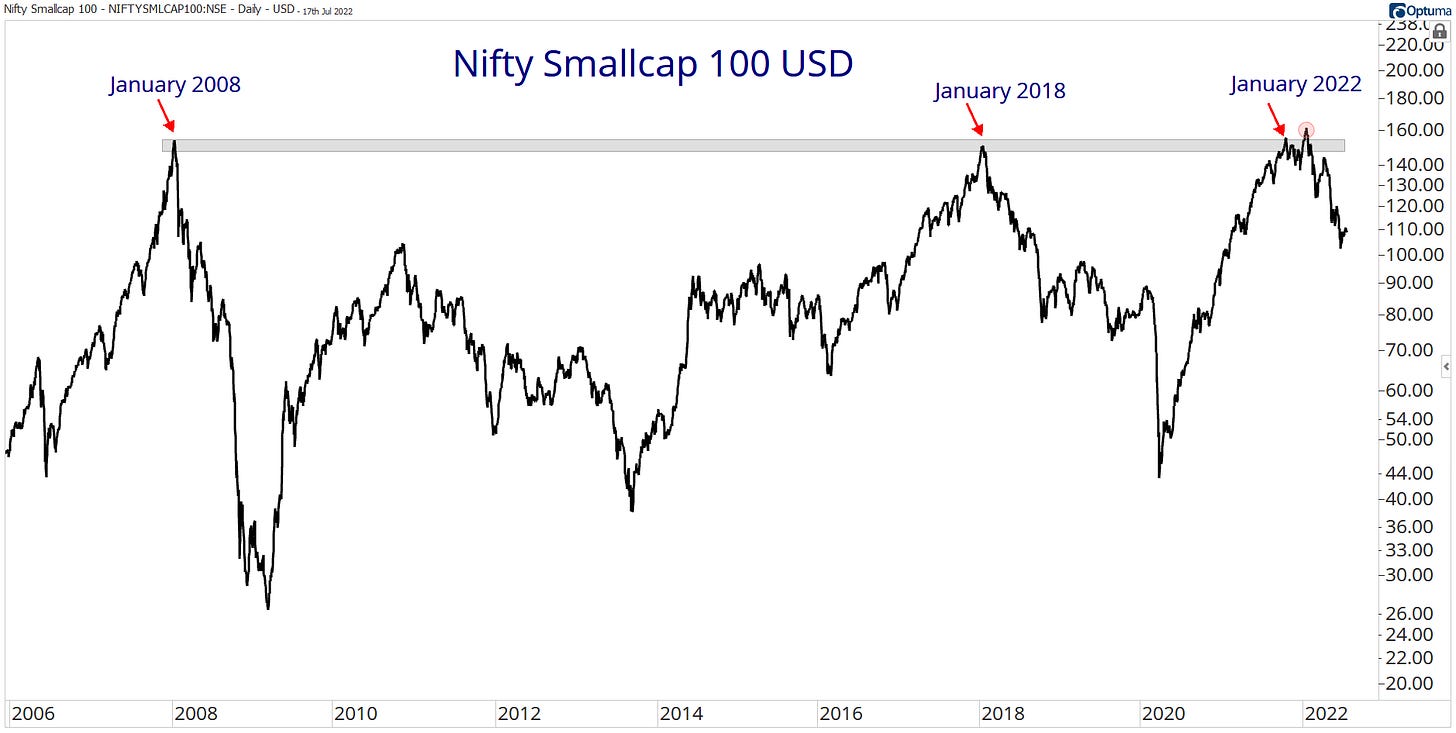

The last post came on October 25th, 2021. The market peaked in the same week. Now in hindsight, the Nifty small-cap USD turns out to be a super important chart.

Nifty 50 dictates the market's major trend, so we need to be aware of how it moves. Major gaps have been filled, so March and May low is the zone of control for bulls.

Nifty 500 has also been holding above the key level of 13,360. We can witness the strength from High low index. It’s forming a divergence which indicates less number of stocks formed a new 52-week low in June.

We should continue to go along with outperforming sectors like AUTO, Capital goods, and FMCG. A potential reversal in underperformed like Pharma is a factor to watch out for. The first sign would be more and more stocks breaking above the shorter period consolidation base.

We have a common market structure across indices and Stocks. It looks something like this.

Price is below 200EMA and above 50EMA.

While the index is making lower lows and lower highs. Considering this structure, we can find stocks forming a base with no new low in June 2022 and above 50EMA, below 200EMA.

Start by dividing returns into five quadrants and focusing on the 3rd, 4th, and 5th quadrants. So, you’ll be able to spot names that are turning up and can benefit from the potential reversal of the broader market.

One more interesting heuristic you can add is stocks making new relative highs before absolute price.

Example: CGpowers is making a new 52-week high relative to Nifty 500 way before its absolute price.

Federal Bank is also making a new relative 52-week high before price.

More examples of new six months relative high before price: TATA Motors, Concor, PI Industries.

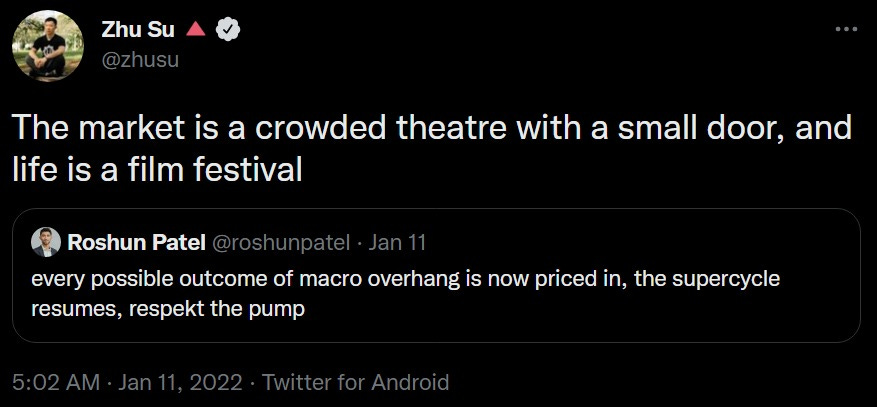

Everyone has their version of what markets are. Some describe it in a typical definition, others in an aphorism.

Over two quarters, the crypto markets have been in hot water. We have seen a series of liquidations by sector companies.

One case that caught my eye is a tweet from Three arrow capital co-founder Su Zhu.

Here he rephases the quote from Nassim Nicholas Taleb’s book Dynamic Hedging (1997).

“The market is like a large movie theater with a small door. And the best way to detect a sucker is to see if his focus is on the size of the theater rather than that of the door.”

- Nassim Nicholas Taleb

The major noise in crypto religion is about the sheer size of the opportunity. All are busy looking at the size of the movie theater instead of its weak foundation.

Next time you get thrown away with words like the Black swan, Antifragile, etc., you need to be aware of your money manager’s idea about the market.

No life is not a film festive it’s suffering at best. <dark>

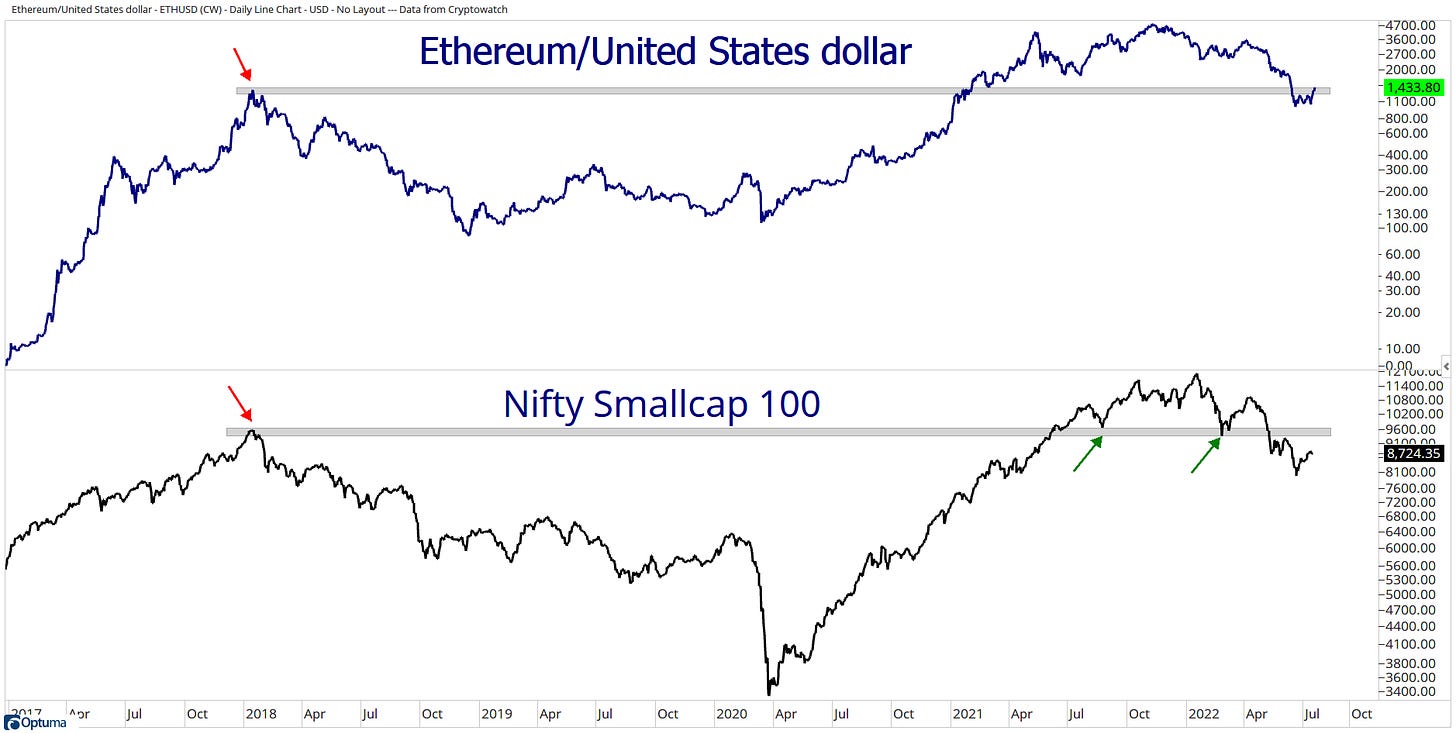

Crypto market data has its importance. It helps in analyzing the risk-on sentiments. If money is going to crypto, there’s a liquidity surge, and we can benefit from this information.

Take a look at Nifty Smallcap and Ethereum.

What remains common after every big market decline?

Investors blame others for their financial decisions. One should accept mistakes and owe themselves instead of blaming some influencer, journalist, etc., for suggesting. Of course, these peeps may have a vested interest. So, it’s important to choose your advisor wisely. Blaming, disliking, and hostility only increase problems, destabilize our minds, and one can repeat the same mistake in a different form.