Weekend Rundown: Smallcap | Sensex | Relative Trends

Sensex closed at its ATH with primary trends remains in favor of the Bulls. In the short term, we will be looking at the sustenance of 50,000.

Top financial names are knocking above February highs. Are we finally getting participation from largecap financial stock? It would defiantly help nifty to sustain at ATH.

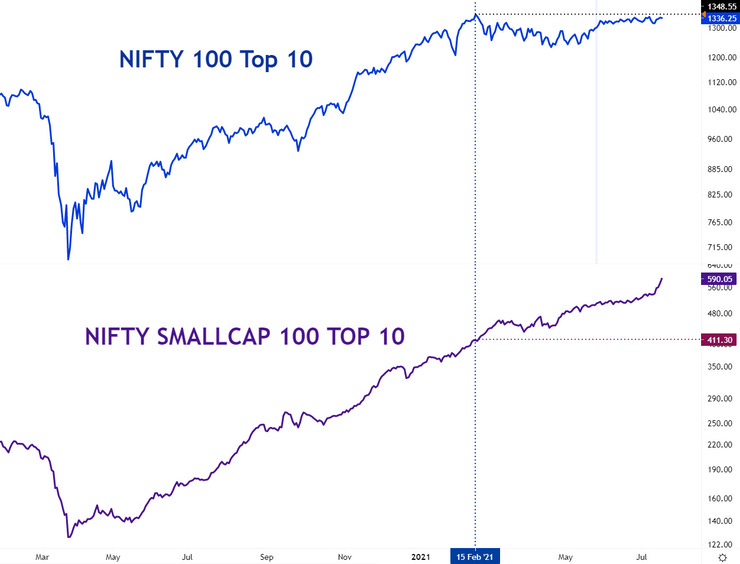

Top smallcap stocks continues to outperform top largecap names. It shows the risk appetite among participants.

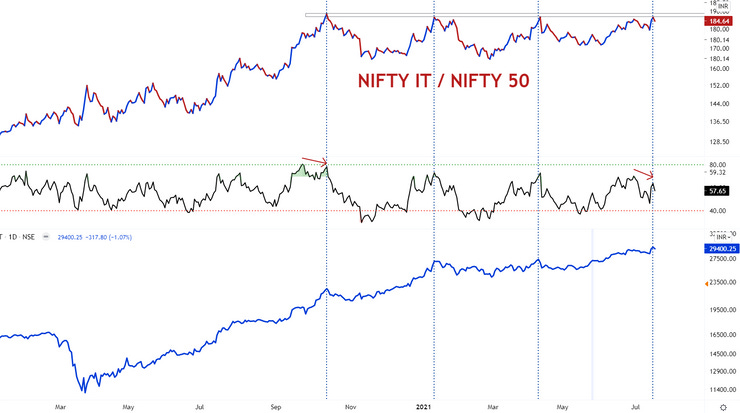

Nifty IT is among the strongest sector of the market. In the short term, it could pause while opportunities remain in smallcap IT names.

Nifty Auto is making a lower high as it trades below the March '21 high.

Nifty 50 closed at an all-time high with the least participation from the auto segment.

Nifty Energy is at a critical juncture. Currently, it's lying at the previous swing high and remains weaker in comparison to Nifty 50.

Godrej Consumer Products

Here sustenance above 670 will activate the setup. On the weekly timeframe, RSI is above 70 for the first some since 2018 high.

Bajaj Holdings

In BAJAJHLDNG, the bias is for upside as long as it remains above 3,800.

To buy the pullback or wait for the breakout. It all depends on the market environment study using dow theory. Sector making a Higher high on the daily timeframe we can buy a pullback or breakout setup, but if the sector making a lower high, a breakout confirmation is essential.

Pricing Mechanism ≠ Fundamental Perception. Until Next week.🖖